Luke W., Chief Digital Officer

How we helped a multinational bank reduce fraud by 43% and increase customer satisfaction scores by 27%

Luke W., Chief Digital Officer

A top-tier multinational bank with operations in 35 countries, serving over 25 million customers and managing more than $500 billion in assets.

Rising fraud cases, customer dissatisfaction with service personalization, and increasing operational costs in their digital banking division.

Advanced fraud detection system, AI-powered customer experience platform, and intelligent process automation for operations.

Reduction in fraud incidents

Increase in customer satisfaction

Reduction in operational costs

Annual cost savings

Our client, a leading multinational bank, was facing significant challenges in three critical areas of their business. First, they were experiencing an alarming increase in sophisticated fraud attempts across their digital channels, resulting in substantial financial losses and eroding customer trust.

Second, their customer experience metrics were declining as customers increasingly expected personalized services that the bank's legacy systems couldn't deliver. Finally, operational costs in their digital banking division were steadily rising due to inefficient processes and increasing regulatory compliance requirements.

"We were constantly playing catch-up with fraudsters while simultaneously trying to meet rising customer expectations for personalization. Our legacy systems weren't designed for the speed and sophistication required in today's digital banking environment."

— Luke W., Chief Digital Officer

After conducting a comprehensive assessment of the client's digital infrastructure, data systems, and operational workflows, we developed a three-part AI strategy focusing on fraud detection, customer experience enhancement, and operational efficiency.

We developed a sophisticated AI-powered fraud detection system that:

The system used deep learning models trained on anonymized historical transaction data, enabling it to detect subtle patterns invisible to rule-based systems while minimizing false positives.

We implemented a customer experience platform that:

This platform integrated with the bank's existing CRM and transaction systems to create a unified customer view while ensuring all data handling complied with global financial regulations.

We designed an intelligent process automation solution that:

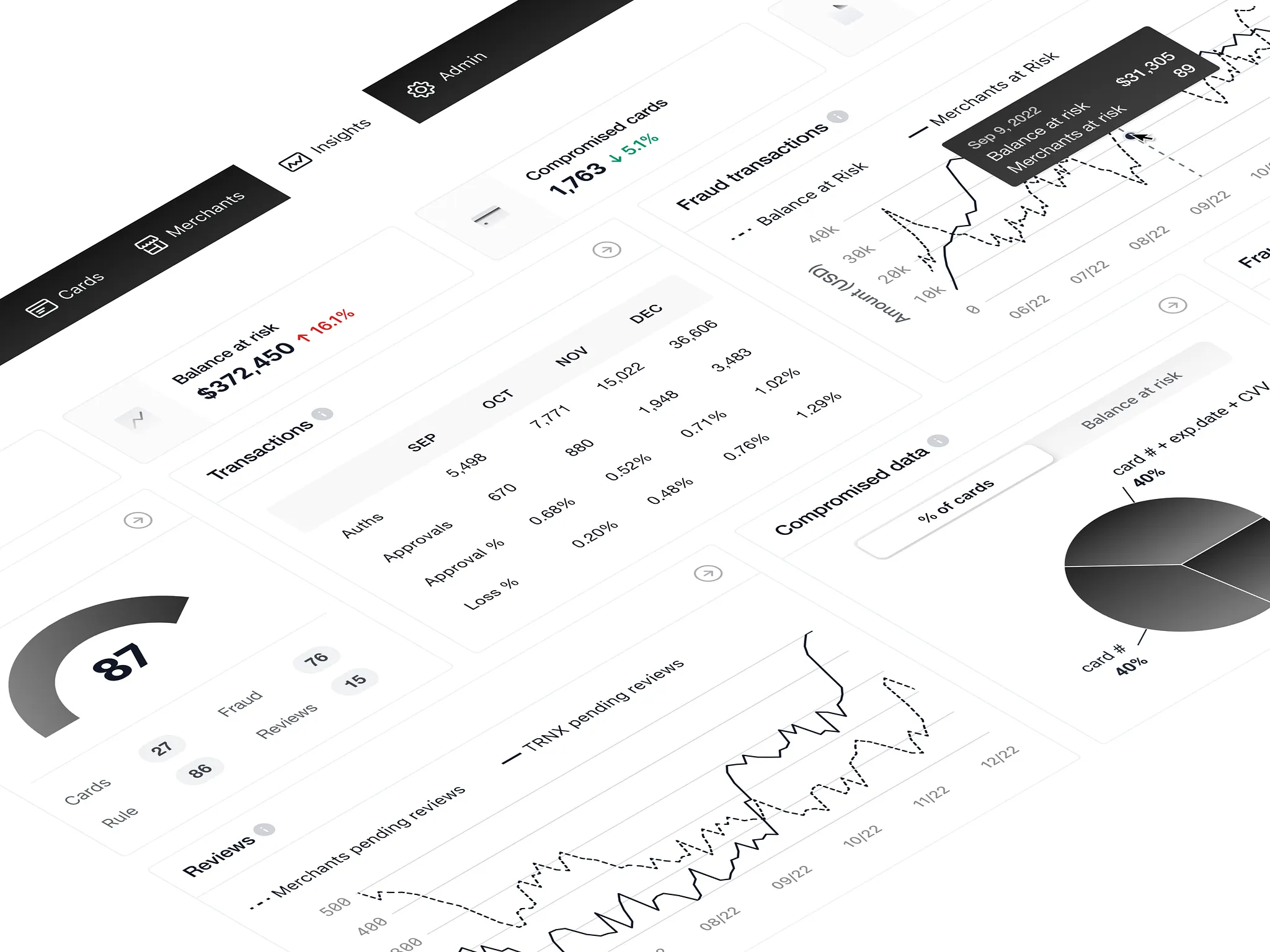

The fraud detection dashboard showing real-time transaction monitoring

We executed this transformation through a carefully phased approach:

Within 9 months of full implementation, the client achieved remarkable improvements:

"The ZeltAI team delivered solutions that transformed our digital banking operations. Not only did they help us dramatically reduce fraud, but they helped turn our digital channels into a competitive advantage. The personalization capabilities have changed how our customers view their relationship with us, from transactional to truly consultative."

— Luke W., Chief Digital Officer

Given the highly regulated nature of financial services, we implemented several measures to ensure security and compliance:

This project yielded several valuable insights for financial services AI implementations:

This case study demonstrates how thoughtfully implemented AI can simultaneously address multiple critical challenges in financial services. By enhancing fraud detection, personalizing customer experiences, and streamlining operations, we helped our client achieve transformative results across their business.

The success of this implementation has led to an expanded partnership focused on developing advanced anti-money laundering capabilities and AI-driven financial advisory services.

Let's discuss how AI can improve security, customer experience, and operational efficiency in your organization.